Starting A Business

Our mission is to help businesses prosper through advocacy, education and exposure.Steps for Starting a Business in St. Lucie County

Registering a business in Florida may require an entity to register not only at the State level but also with the local county government. Corporate entities are usually required to register with the Division of Corporations, while many professions are required to register with the Department of Business and Professional Regulation. County occupational licenses (business tax receipts) are usually obtained from the local county government. Visit www.sunbiz.org for complete details or call (850) 245-6058.

Florida requires state licensing or certificate of competency for many professionals and occupations. Many require special training and prior examinant. For details call (850) 487-1395 or visit www.myfloridalicense.com/dbpr/index.html.

If your business does not operate as a corporation and you run your business under a name other than your personal full name, you need to register the business with a “fictitious” name. For details call (850) 245-6058 or visit www.sunbiz.org.

Most businesses must apply for and receive a Federal Employer Identification Number (EIN). This registration is required even though a business may not have employees. Visit www.irs.gov and search EIN for additional information or call (800) 829-1040.

Taxes on your business and other federal or state reporting requirements will depend on the nature of the business, its legal structure and whether or not you have employees. At the state level, visit www.myflorida.com/dor and at the federal level, visit www.irs.gov/businesses.

General Guidelines for obtaining Business Tax Receipt (formerly known as an occupational license)

There are four different jurisdictions in St. Lucie County requiring a business tax receipt for conducting business – St. Lucie Village; Fort Pierce; Port St. Lucie and the unincorporated area of St. Lucie County. Each jurisdiction has a Building or Planning and Zoning Department that will determine the zoning compliance for the location of the business prior to the issuance of a business tax receipt.

St. Lucie Village: 2841 Old Dixie Highway, Town Hall (772) 466-6900

Fort Pierce City Hall: 101 N. US 1, (772) 460-2200

Port St. Lucie City Hall:121 SW Port St. Lucie Blvd, Building A (772) 871-5225

St. Lucie County Building and Zoning: 2300 Virginia Avenue, Fort Pierce, (772) 462-1553

Upon obtaining a city issued business tax receipt and/or zoning compliance certificate, you must also obtain a business tax receipt (occupational license) from the St. Lucie County Tax Collector.

Fill out the Business Tax Receipt (occupational license) application here: Business Tax Receipt Application

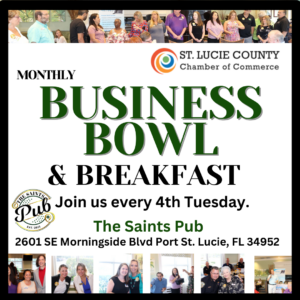

The St. Lucie County Chamber of Commerce hosts SCORE each week providing FREE business start up assistance. Call (772) 489-0548 to make your appointment.

You may also contact the Small Business Development Center at Indian River State College at (772) 462-4772 for assistance.